when are property taxes due in illinois 2019

Has yet to be determined. The Illinois Department of Revenue does not administer property tax.

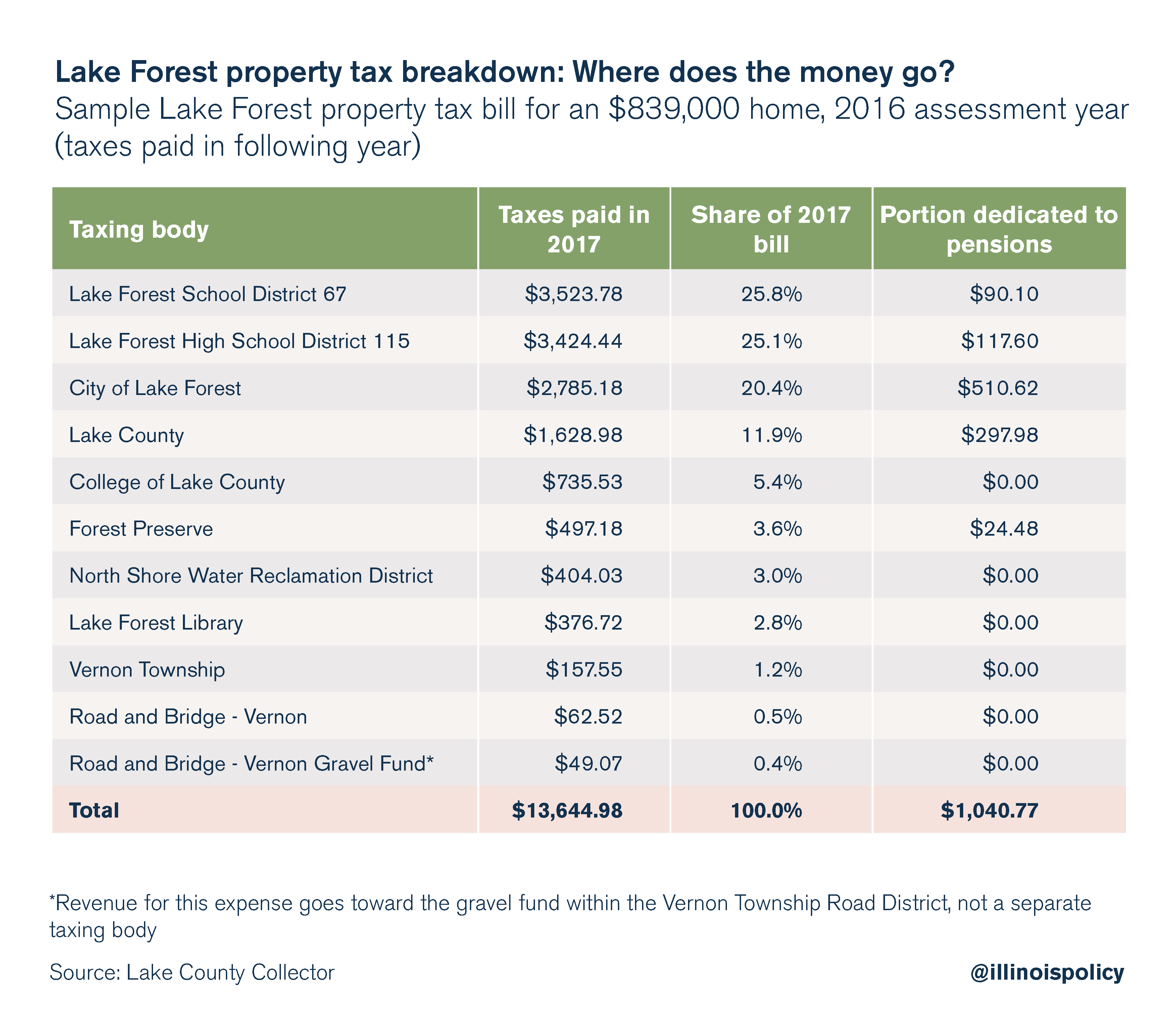

Lake County Homeowners Where Do Your Property Taxes Go

Will County will mail real estate property tax bills on Wednesday May 1 2019.

. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill. Corporate purposes general fund including amounts for fire protection ambulance services and imrf. Property tax due dates for 2019 taxes payable in 2020.

Now rampant inflation is giving local taxing bodies the power to raise rates by 5. It is managed by the local governments including cities counties and taxing districts. In most counties property taxes are paid in two installments usually June 1 and September 1.

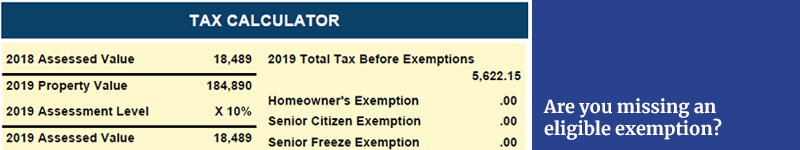

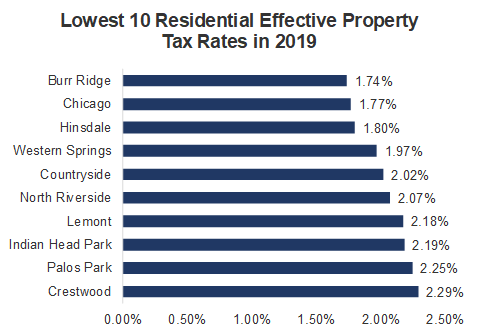

The typical homeowner in illinois pays 4527 annually in. If you are a. Property taxes average approximately 25 of the Citys total General Fund revenue.

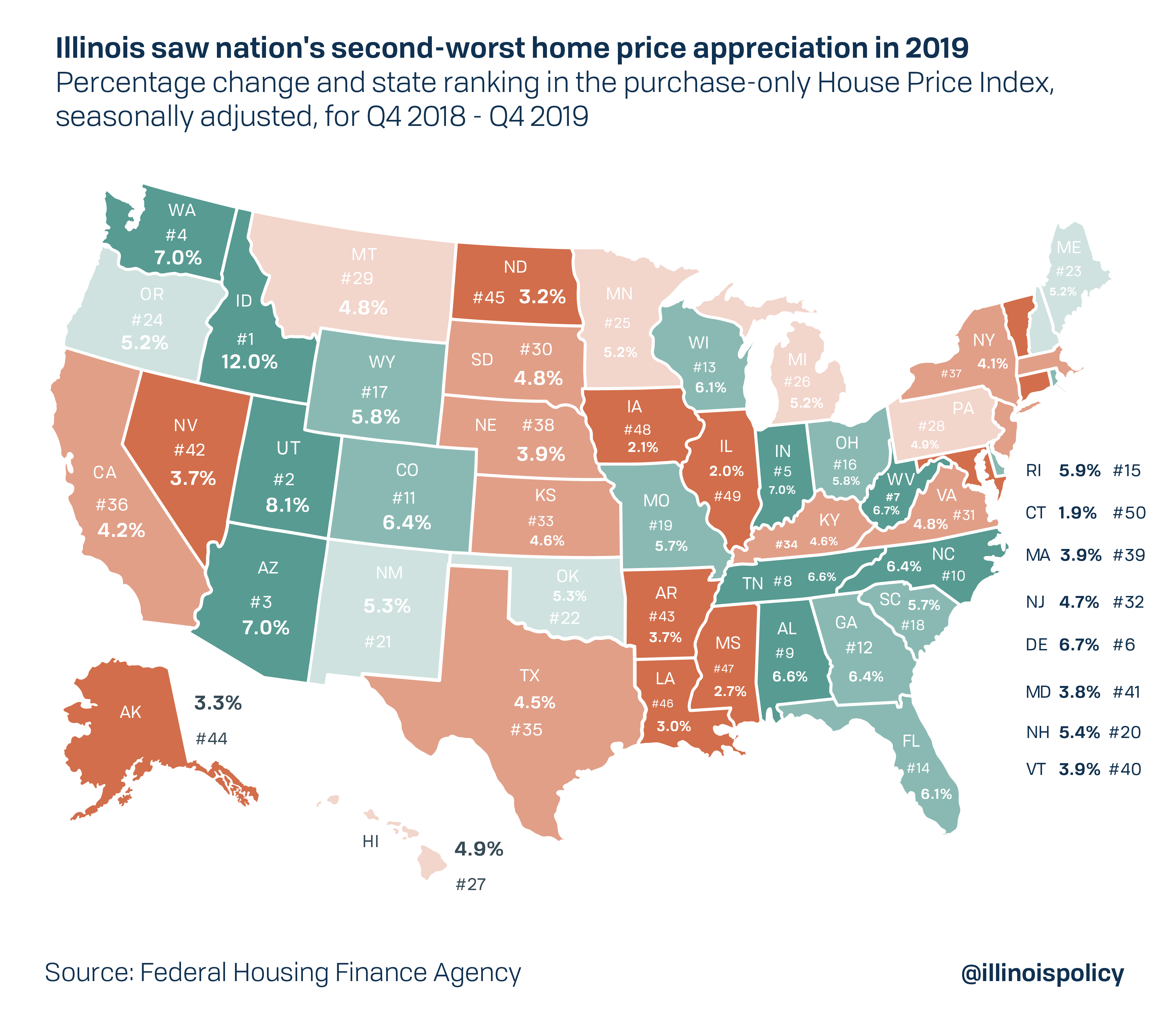

If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill. Joe Sosnowski R-Rockford filed House Bill 5772 which calls for a 90-day delay without penalties on 2019 property tax payments which come due during the next. Illinois Home Values Decline Due To Rising Property Taxes.

Due dates are June 6 and Sept. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on. The first installment is due on June 3 2019 and the second installment is due on September 3 2019.

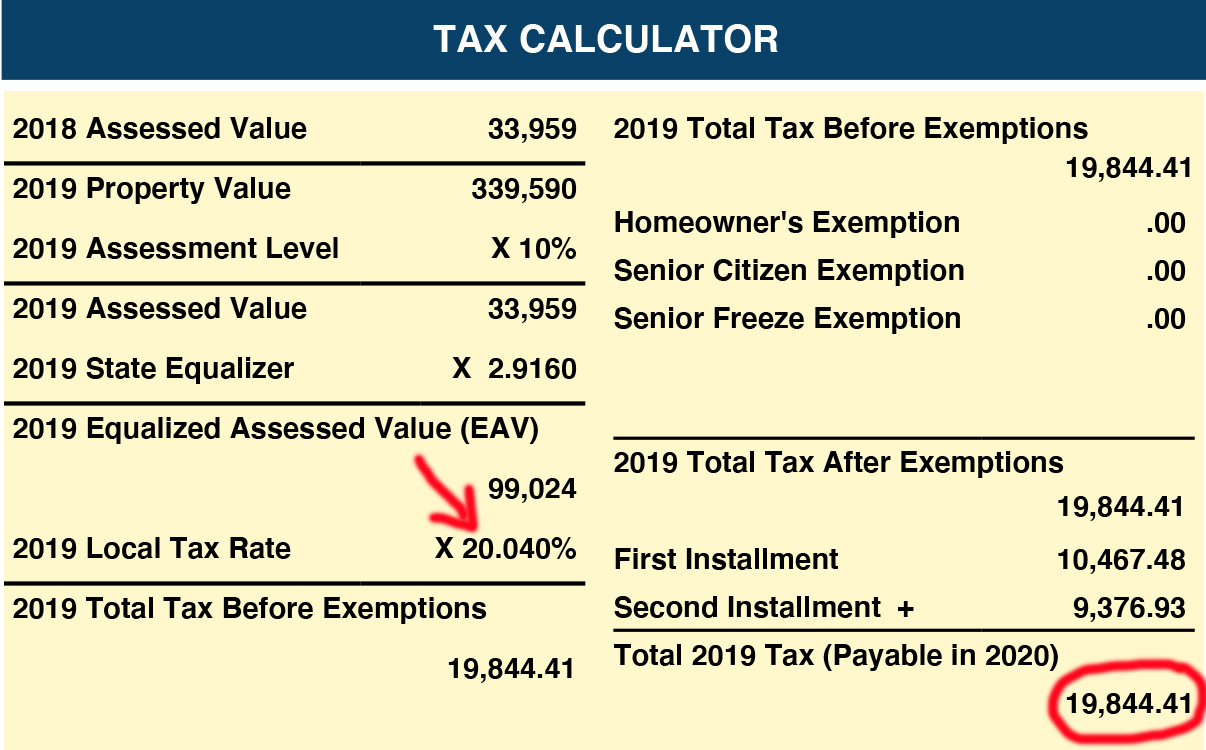

Illinois was home to the nations second-highest property taxes in 2021. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. Your real estate tax deduction for 2020 2019 taxes in Illinois are billed in 2020 is what you paid directly.

Yes to did you own your primary residence. Property owners who pay their taxes on time may be able to save money. For now the September 1.

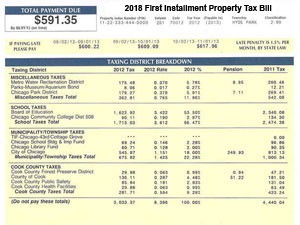

Property tax due dates for 2019 taxes payable in 2020. The Second Installment of 2020 taxes is due August 2 2021 with application of late. These bills are for taxes owed in 2018.

Wilmingtons current FY 2023 property tax rate is 2115 per 100 of the assessed value of a property. April 12 2021 1140 AM. Residents wanting information about anything related to property taxes or fees paid to the county can click through the links.

173 of home value. Tax Year 2021 Second Installment Property Tax Due Date. Tax amount varies by county.

Are Illinois property taxes extended. Are Illinois property taxes extended. Illinois is not extending the filing or payment due dates for tax year 2019 returns for partnerships including nonresident withholding Form IL-1065 which still falls on April 15.

Welcome to Madison County Illinois. The mailing of the bills is dependent on the completion of data by other local. The First Installment must be paid by June 4 2019 with.

Illinois is facing a crisis due to taxpayers fleeing the state due to high taxes. For now the September 1.

La Grange Il Approves 2 78 Property Tax Increase Property Tax Bill Appeals For Cook County Illinois

Illinois Income Tax Rate And Brackets 2019

Fix Or Sell Illinois High Property Taxes Make Either Tough

Property Tax City Of Decatur Il

Cook County Property Taxes First Installment Coming Due Kensington

2022 Property Tax Bill Assistance Cook County Assessor S Office

Property Taxes Village Of Oswego Illinois

Spiral Of Decline Heavy Burden For Homeowners Better Government Association

Illinois House Value Growth Nation S 2nd Worst In 2019

Property Taxes Focus Of Crain S Op Ed Penned By Boma Chicago Executive Director Farzin Parang Boma Chicago

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

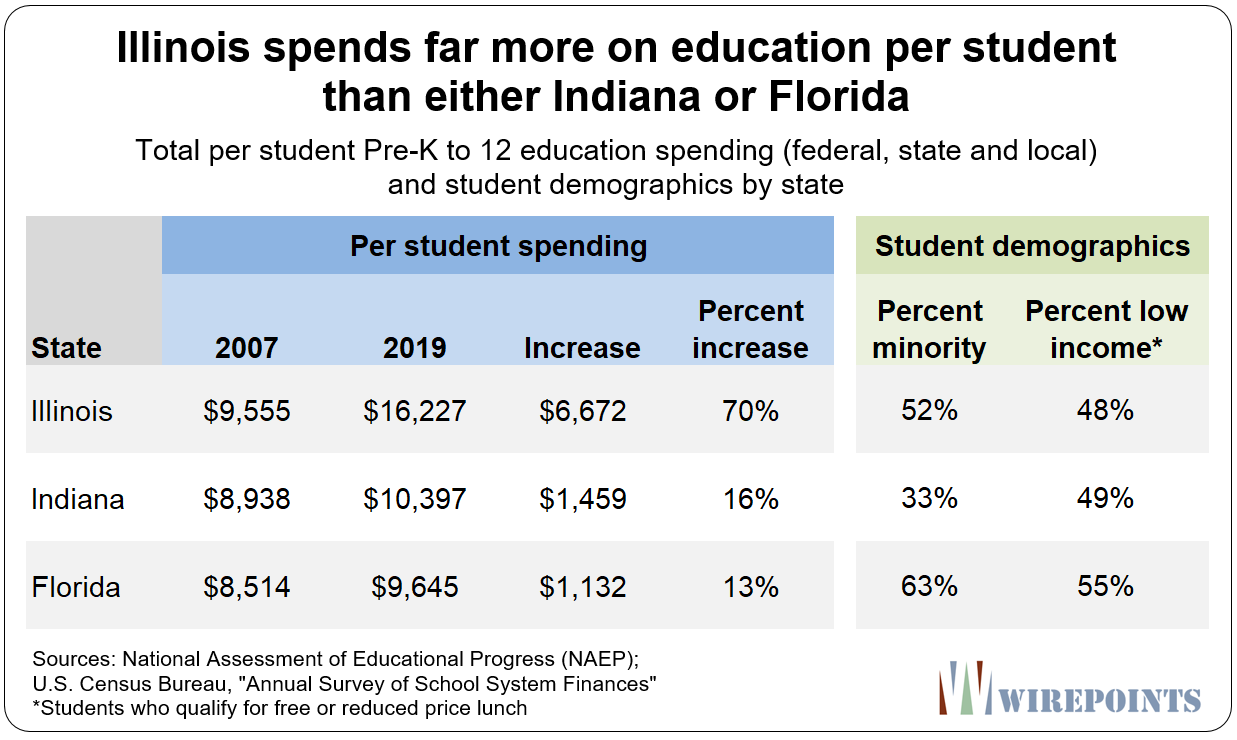

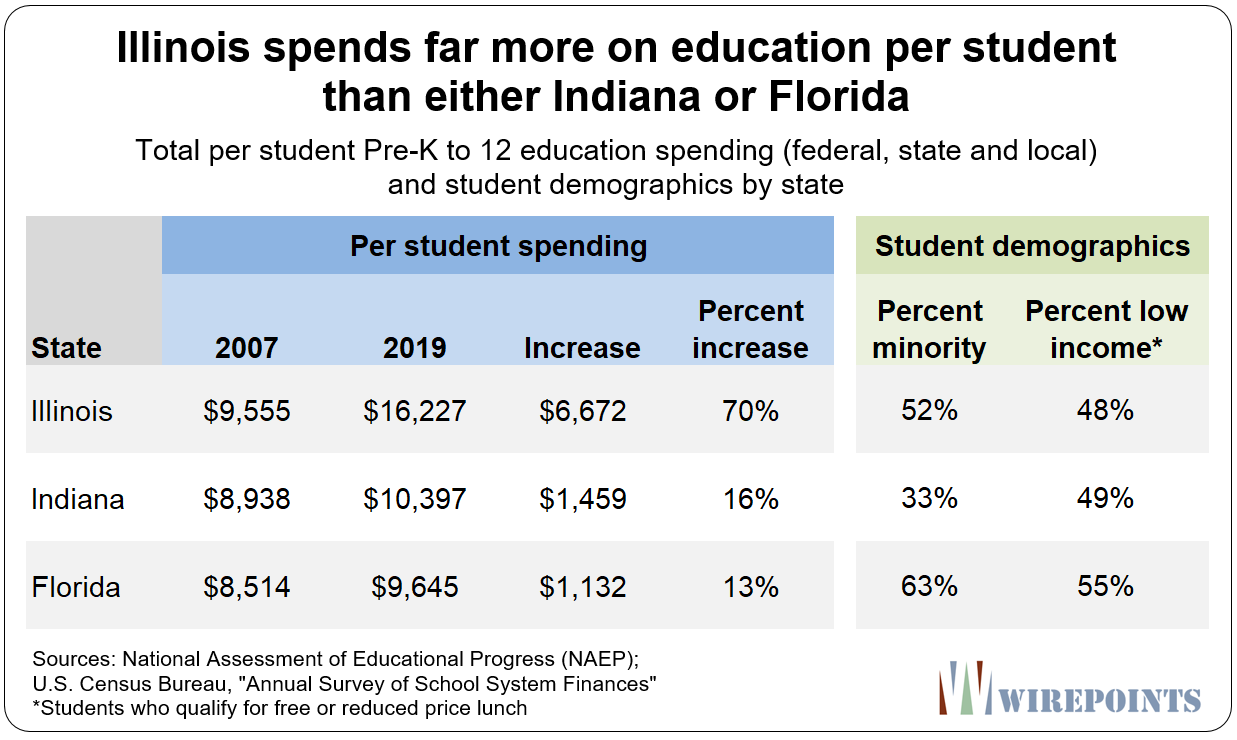

Illinoisans Would Pay 40 Less In Property Taxes If The State Spent At Levels Where Students Perform Better Florida Madison St Clair Record

Property Tax Relief For Military Members State Representative Debbie Meyers Martin

There S Help For Senior Citizens Struggling To Pay Cook County Property Taxes Building A Better 7th Together

Property Taxes Jump Most In Four Years With Sun Belt Catching Up

Why Property Taxes Are So High In Illinois Glenn L Udell Youtube

U S Property Taxes Levied On Single Family Homes In 2018 Increased 4 Percent To More Than 304 Billion Attom

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom